How ‘High Fidelity’ Became a $35 Million Cannabis Company in Vermont Without Touching a Plant

Posted on April 27th, 2021 to Cannabis News by

You’ve never heard of them, but High Fidelity is “Vermont’s largest independent cannabis company,” raking in $35 million in revenue since 2013, via two medical cannabis dispensary licenses and a legal CBD business.

The eight figure sum first reported by Cannabis Investor (via press release) is staggering in tiny Vermont, especially since THC cannabis can’t yet be legally sold to adults without a medical card. However, the story of High Fidelity is not unique in the THC cannabis industry, where the intangible licenses to operate the businesses are the real commodity, and the plants are an afterthought.

PROHIBITION NECESSITATES CREATIVE ACCOUNTING

The first step to understanding how a Vermont business without an office or website apparently generated $35 million in revenue over seven years is understanding what Federal cannabis policy means for those trying to enter the legal industry.

Regardless of who occupies the White House or controls Congress, or what embattled Governor needs to distract from scandal, cannabis with >1% delta-9 THC is still a schedule one narcotic and controlled substance by the Federal Government.

The ‘Schedule 1″ status of THC cannabis means that due to laws passed in the early 1980s to prevent money-laundering, any business that produces, distributes, or touches THC cannabis is forbidden from writing off normal operating expenses, and as such, often pays 3-4x more taxes than non-cannabis businesses.

Since these normally-exempt operating costs like rent and employees are tax burdens for THC cannabis companies, a common strategy is to subcontract operating expenses (like payroll) to third-party companies — often ones also controlled or owned by the same people that own the THC cannabis company.

Federal cannabis policy not only means that THC cannabis businesses are more expensive to operate, they’re also much more expensive to start, because banks — and everyone regulated by the Federal Government — can’t give loans to state-legal THC cannabis businesses.

Whether those necessary funds come from family, friends, or a private group of investors, those wealthy investors also can’t move millions of dollars across state lines and financial institutions directly into a federally-illegal business.

Again, regulation and reality dictate that before one even considers running a cannabis business, it’s first necessary to create a non-cannabis business which can serve as a vehicle to transport legal funds into and out of a legal THC cannabis business without interference from the Federal Government.

THE LICENSE TO BILL

If someone in a state where it’s legal asked about the first step to growing legal THC cannabis, the answer would have nothing to do with seeds, lights, or dirt.

If the question was instead about the first step to selling legal THC cannabis, the answer would have nothing to do with buildings, employees, or inventory.

The singular asset and first function of any legal THC cannabis business is to obtain the state license to exist, and when secured, the license to grow, manufacture, and sell cannabis and controlling that license becomes a business in itself.

With the ability to detach the license to operate a cannabis dispensary from the federally-prohibited plants or the state regulators themselves, an ‘independent’ for-profit business that *controls* that dispensary operation has now been sterilized into a business that can raise money and issue shares for the dispensary operation.

The word *control* is the key word here and the way dispensary license-holders control cannabis operations is similar to the way that nonprofits control their program operations: the nonprofit organization doesn’t need to have the assets, it controls the mission and decides who it hires to accomplish the mission.

If your mission is to purchase and dispense an extremely valuable and limited (legally) product like THC cannabis, then being a vertically-integrated licensee means you can purchase it from yourself without competition, that operational control is a license to grow money.

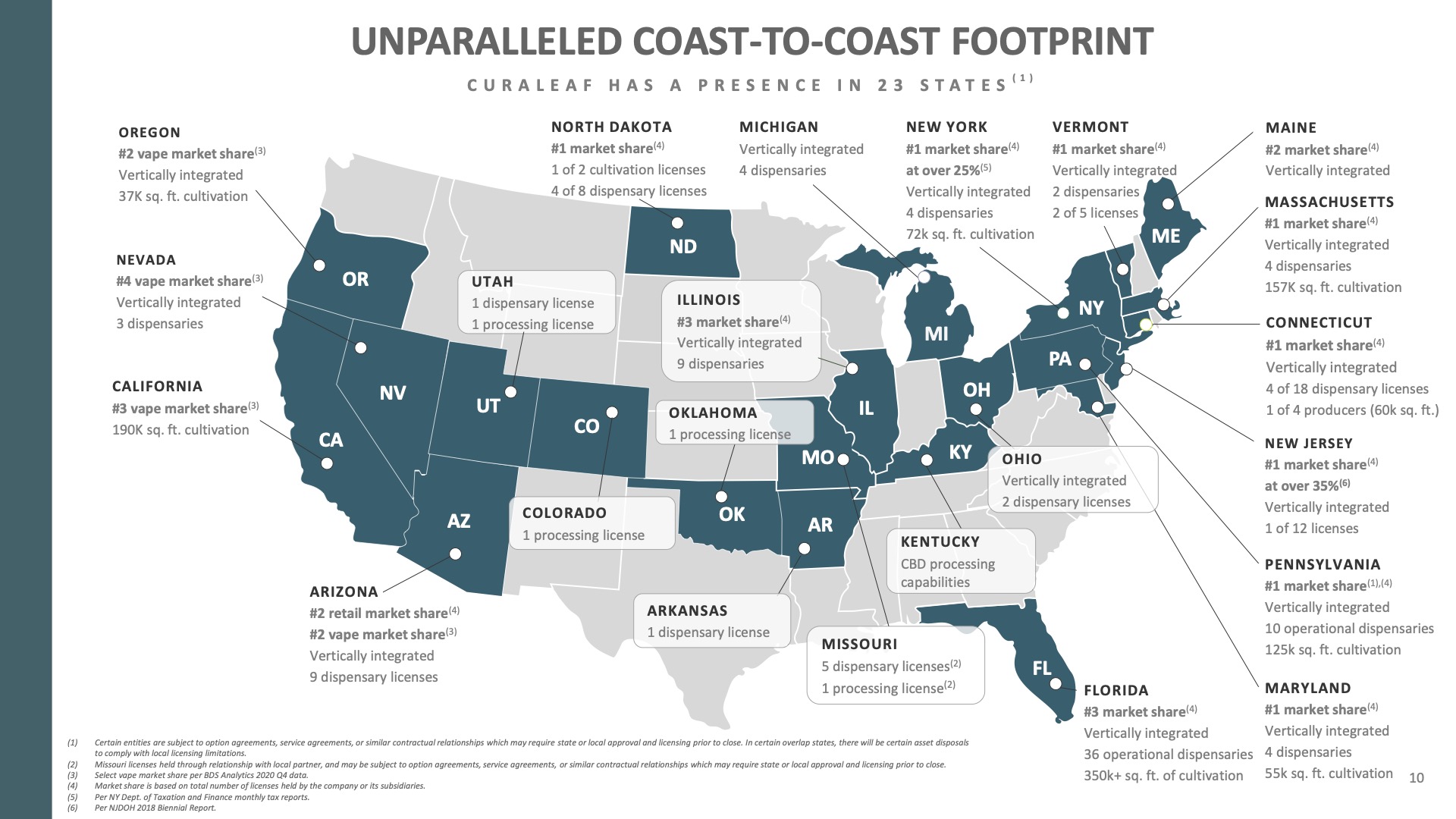

Controlling and consolidating access to 40% of the dispensary licenses and 70% of the medical patients in Vermont may be the business of High Fidelity in Vermont, but it’s not a unique model, it’s the industry standard.

And despite apparent impossibility of running a legal international cannabis cartel, the layering of unregulated businesses is an international industry, even including an alleged oligarch Russian billionaire.

Each state controls how easy and/or expensive it is to get a license, and the approaches understandably differ in Oklahoma and Massachusetts. What IS consistent in each state, is the absolutely enormous first-mover advantage for those with licenses, especially those who have medical marijuana licenses in states that transition to adult use.

In New York for example, the advantage for the original ten medical dispensary licensees are projected to be enormous, especially thanks to vertical integration that allows these businesses — and only these businesses — to supply themselves.

According to a recent report from Viridian Capital examined by Debra Borchardt, that vertical integration can mean up to a 40% advantage over an independent retailer in gross margin.

“Using rough Massachusetts pricing ($4500/lbs. flower retail and $3000 wholesale) and cost of production ($1200/lbs. flower) as a proxy for New York, the existing New York license holders can achieve a 73% gross margin on the sale of one pound of flower while a non-vertically integrated retailer achieves 33%,” read a new report by Viridian.

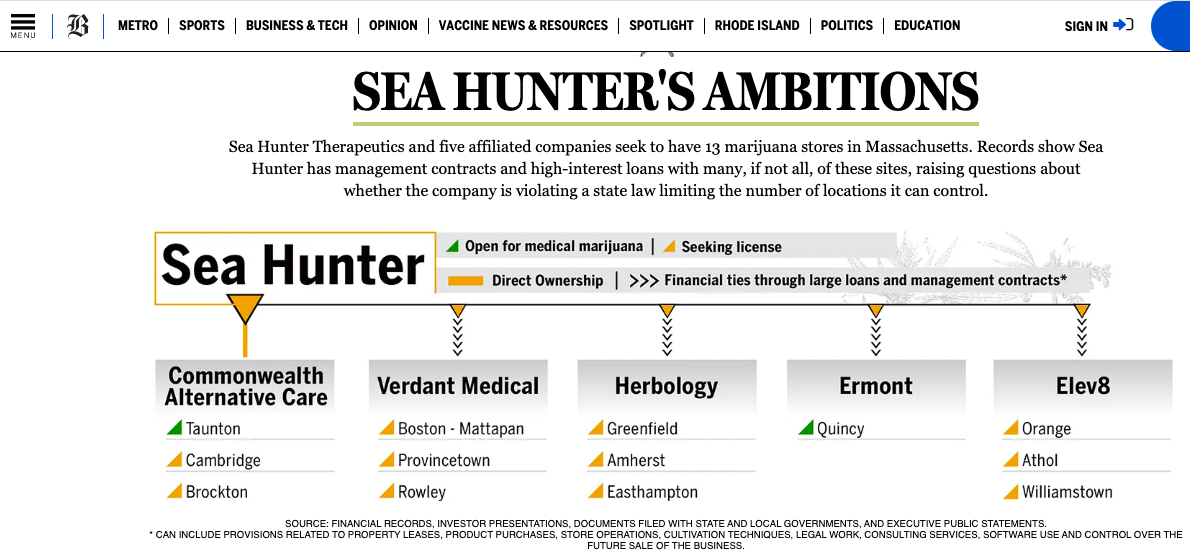

Speaking of Massachusetts, legislators, advocates and regulators in the Bay State were all aware of the potential for consolidation and attempted to prevent any single operators from dominating a state market.

“Of the 12 recreational shops that have opened so far here, all but two are owned by or have ties to large, out-of-state investors or multi-state operators. Meanwhile, out of more than 120 applicants approved for a state program aimed at helping startups from minority and disadvantaged communities, not one has opened yet, largely due to a lack of funding.”

BACK TO VERMONT

$35 Million in revenue over seven years isn’t a striking figure in Manhattan or Massachusetts, but in Vermont, it’s a fairly stunning statistic where longer-than-expected political reforms and CBD hemp price drops have Vermont’s other cannabis-based businesses going bankrupt, ‘on-hiatus’, and/or diversifying to stay afloat.

With Vermont recently declaring Delta-8 THC as a synthetic cannabinoid and subsequently banning it, the prospects of other Vermont cannabis companies reaching such robust revenues from cannabinoids any time soon are even dimmer.

Neither High Fidelity’s description as ‘Vermont’s largest independent cannabis company’, nor the $35 million figure were the actual subjects of the March 1, 2021 press release which described a potential collaboration between an Australia-based cannabis producer called Creso Pharma and Ceres Natural Remedies.

CERES is a leading Vermont headquartered distribution company, specialising in plant based remedies and CBD and hemp products for the US market. It is the sister company to Champlain Valley Dispensary, Vermont’s first licensed and only independent medicinal cannabis company.

Champlain Valley Dispensary and CERES are both subsidiaries of High Fidelity, Vermont’s largest independent cannabis company. High Fidelity currently operates two of the five vertically integrated cannabis licences available in the state and services 70% of registered patients. Since 2013, High Fidelity has generated in excess of US$35 million in revenue.

WHO IS HIGH FIDELITY?

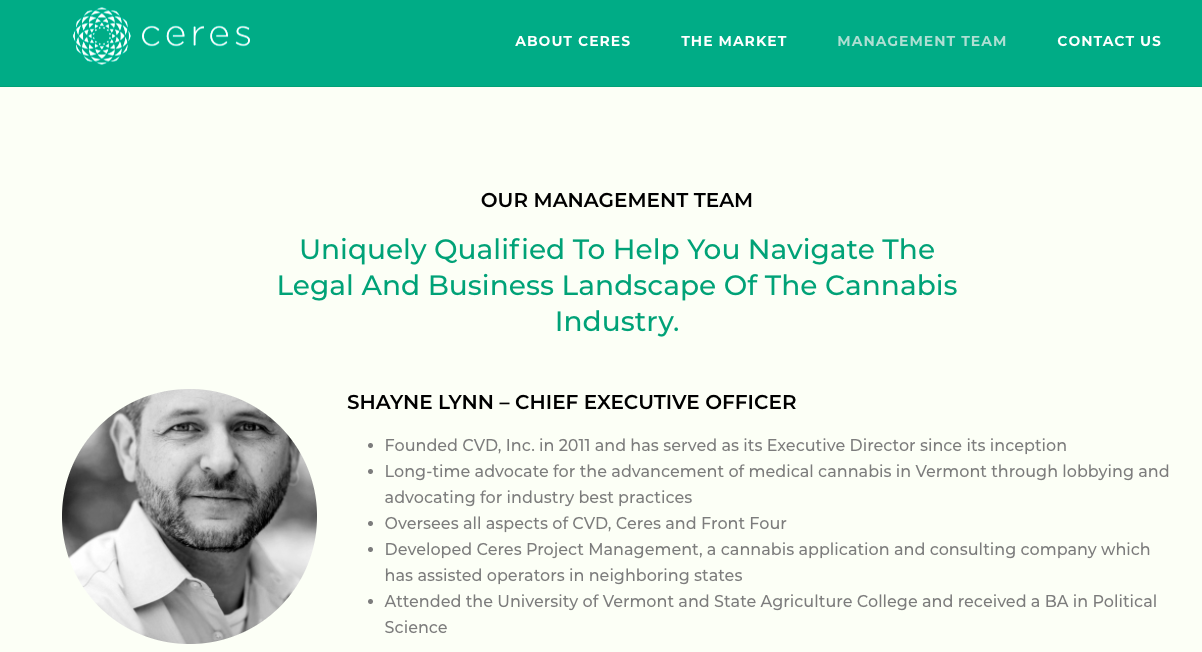

According to documents on the Vermont Secretary of State website, High Fidelity Inc. was formed as a General Corporation with 10,000 common shares in late December 2017 listing the law firm Gravel and Shea as the registered agent. In its 2020 annual report, High Fidelity Inc. lists William ‘Chip’ Mason IV as the Incorporator, and Shayne Lynn as the Executive Director.

Mason has also been a member of Burlington’s City Council (D-Ward 5) since 2012, and recently recused himself from a January 2021 Burlington City Council retail cannabis licensing discussion citing a “professional conflict of interest,” to VTDigger’s Katya Schwenk.

In addition to High Fidelity, Shayne Lynn’s name also appears as the founder or leader of several other Vermont cannabis businesses: Champlain Valley Dispensary Inc., Southern Vermont Wellness, Ceres Natural Remedies and Ceres Project Management all of which were incorporated by another Burlington attorney, registered lobbyist David Mickenberg.

While Lynn uses the address and email of the Champlain Valley Dispensary’s medical cannabis facility in Milton, Vermont, High Fidelity documents on the Vermont Secretary of State website do not list any other assumed business names or associates any other business registrants.

There is an apparently unrelated Washington-based cannabis company with the same name; however, despite the recent description in the Australian press release, of High Fidelity as ‘Vermont’s largest cannabis company’, High Fidelity Inc, maintains no apparent web presence other than a VTDigger press release, which lists ‘Shayne Lynn, High Fidelity Inc.’ as a speaker.

BEFORE YOU WERE PAYING ATTENTION

Between the Australian press release and the VTDigger credit, Lynn’s connection with High Fidelity seems clear; however, the 2013 start date in the press release contradicts the 2017 formation date on the Vermont Secretary of State website.

So if not High Fidelity, was there another cannabis holding company that Lynn and others in Vermont founded back in 2013? And if so, how did it rack up $35 million in revenue?

Enter Ceres Project Management, another business started by Lynn whose website offers “consulting and management services for cultivators and dispensaries of legal cannabis”, and according to their own website, have successfully “directed the operations of two of the five vertically integrated medical cannabis licenses in the state of Vermont.”

“Ceres Project Management has successfully directed the operations of two of the five vertically integrated medical cannabis licenses in the state of Vermont. Champlain Valley Dispensary was awarded the first license in Vermont in the fall of 2012. It began serving qualifying patients in July of 2013. It was awarded a second license to operate Southern Vermont Wellness in 2014 and began dispensing cannabis in February of 2015. Over the course of 6+ years of operation, these licenses have grown to include 2 production facilities and 4 dispensing locations geographically disperse across the state. They serve 65% of the patients registered with the Vermont Marijuana Registry (VMR).”

LAYING THE FOUNDATION

For both naively-innocent and stupidly-discriminatory reasons, Vermont lawmakers didn’t initially trust medical cannabis dispensaries. From 2004 through 2011, the state did not allow medical cannabis dispensaries at all, leaving registered medical cannabis patients and caregivers to fend for themselves with a two plant limit and a law enforcement community who viewed medical cannabis with more suspicion than compassion.

In fact, the distrust and unfamiliarity with medical cannabis was so great, that in 2006, a nursing home in Burlington went so far as to call the police to report one of their own residents, Shane Higgins, who was one of only 29 registered patients in the state, and despite suffering severely with MS, had to be driven 40 minutes off-site just to smoke a joint outside.

However, after years of grassroots lobbying efforts by patient advocates like Mark Tucci — who was a central figure in a tight-knit community of patients and caregivers who educated themselves and each other, oftentimes at great legal risk, in how to cultivate high quality cannabis for their own survival — grassroots advocates were gradually flanked by new medical cannabis advocates like Shayne Lynn who came with open eyes, political connections, and lobbying budgets.

That motley conglomeration of grassroots and suits (who didn’t yet hate each other) and their supporters in the Vermont State Senate and then-Representative David Zuckerman (P-Burlington) was eventually successful in 2011 with the passage and signing of Act 65.

Act 65 permitted the licensure of four medical cannabis dispensaries throughout the state, but with one very clear condition: they operate only as nonprofit organizations.

In fact, this nonprofit structure requirement was so specific, that Act 65, the bill that brought medical dispensaries into existence was literally called, “An act relating to registering four nonprofit organizations to dispense marijuana for symptom relief.”

Aside from lobbying expenditures, and their own internal conflict-of-interest policies, a 501c3 nonprofit organization is not restricted about the for-profit company it hires, or what it pays that for-profit company for whatever services it provides. Meaning that a nonprofit medical dispensary could still contract a for-profit company who could run the operations (and accounting) as a management business.

However the Champlain Valley Dispensary, Southern Vermont Wellness, and Vermont’s two other medical cannabis dispensaries operated as nonprofits for those first few years, they didn’t have to continue for long as the medical program expanded significantly in 2017 through the passage of Act 65.

In a familiar pattern, this medical cannabis bill provided both significant concrete positive benefits to medical patients, as well as significant expansion opportunities for the three medical dispensary operators, who not only had more patients, but also the crucial ability to double their retail capacity by dispensing THC cannabis at a second, ‘satellite’ location.

With the value of their business now effectively doubled on paper, and the ability to interact as for-profit businesses, those same three operators added and opened multiple locations in South Burlington, Middlebury and Bennington, as the number of registered patients (who may only purchase legal THC cannabis from one of the five licensed dispensaries) rose by 2000 registered patients from October 2016 to December 2017.

FROM FUNDRAISER TO FOUNDER IN FIVE MONTHS

While the $35 million High Fidelity Inc., business may not have technically existed on paper before 2017, a different company called Ceres Project Management did exist. Both before 2017, and to this day, Ceres Project Management website still contradictorily also claims the operational control of the same two medical dispensaries as High Fidelity..

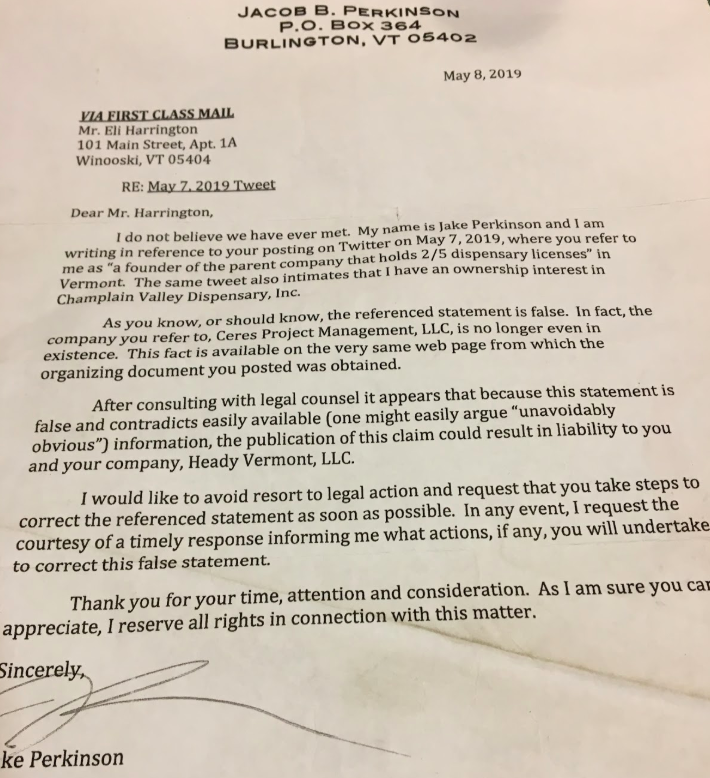

But before High Fidelity, it wasn’t Lynn at the helm of Ceres Project Management, it was instead Jacob ‘Jake’ Perkinson, Esq., who in the course of five months in 2013, went from head of the Vermont Democratic Party to the registered agent for Ceres Project Management and self-described, “founder of Ceres Project Management” and “President of Champlain Valley Dispensary Inc., the largest and oldest medical cannabis dispensary in Vermont”

Technically speaking, the business with the name Ceres Project Management founded by Perkinson was dissolved in 2016, but until that point, Perkinson’s role as the founder was laid out explicitly on an earlier version of the Ceres Project Management website — as was his political prominence in the Vermont Democratic Party.

“From 2011 through 2013, Mr. Perkinson served as the Chairman of the Vermont Democratic State Party and in the 2012 election cycle oversaw one of the greatest organizational, financial, and electoral successes ever achieved by that organization”.

One of the beneficiaries of Perkinson’s successes was the Vermont Democratic Party masthead, Governor Peter Shumlin, who served three terms from 2010 to 2016 and who’s administration would issue four initial medical cannabis dispensary licenses, including two to his former fundraiser Perkinson, now the founder of Ceres Project Management.

Six months after the aforementioned Vermont Democratic Party’s electoral success, Perkinson resigned from his position as Chair in May 2013. Five months later, in August of that same year, Perkinson filed paperwork with the Vermont Secretary of State to incorporate Ceres Project Management LLC for “all legal purposes”.

In February 2015, Perkinson — then described as ‘Counsel, Champlain Valley Dispensary’ — joined a group of Vermont politicians, opponents, and lobbyists visited Colorado on a three-day fact-finding mission.

That group notably included then-Public Safety Commissioner Keith Flynn, Attorney General TJ Donovan, Jake Perkinson — then described as ‘Counsel, Champlain Valley Dispensary’ — and the aforementioned David Mickenberg, another Burlington attorney who is the registered agent for at least two of the businesses that make up the High Fidelity portfolio.

Not technically as a lobbyist for Lynn’s present or Perkinson’s past cannabis businesses, Mickenberg has been professionally prominent in cannabis reforms in the Vermont State House since at least 2015, formally and most recently as a representative of the Marijuana Policy Project (MPP) via the Necrason Group lobbying firm.

For unknown reasons, despite his role as chairman and a founder, Perkinson’s name and affiliation with Ceres Project Management was scrubbed from the Ceres Project Management website in 2016. The company also filed paperwork with the Vermont Secretary of State to change registered agents, dissolve, then re-form with Lynn and Mickenberg as the sole listed incorporators.

In 2017, Perkinson was appointed by Governor Phil Scott as co-chair of a bi-partisan cannabis commission tasked with issuing a report addressing hypothetical recommendations about tax-and-regulate details such as tax rates, prevention funding, and saliva-testing.

When the connection between Perkinson’s previous affiliation with Champlain Valley Dispensary and was reported by Heady Vermont in 2019, Perkinson sent the author a letter denying the connection and threatening a lawsuit.

“you refer to me as ‘a founder of the parent company that holds 2/5 dispensary licenses’ in Vermont. That same tweet also intimates that I have an ownership interest in Champlain Valley Dispensary Inc. As you know, or should know, the referenced statement is false. In fact, the company you refer to, Ceres Project Management LLC, is no longer even in existence…

…the publication of this claim could result in liability to you and your company, Heady Vermont, LLC. I would like to avoid resort to legal action and request that you take steps to correct the referenced statement as soon as possible.”

Heady Vermont did issue a snarky correction, clarifying that the consulting business called Ceres Project Management that claimed control of 2/4 of the medical dispensaries in 2016 founded by Perkinson was dissolved in 2016.

Neither the current Ceres Project Management, nor High Fidelity Inc, nor either of the two medical dispensaries owned and operated by his former business partners publicly list Perkinson as involved in any way, despite his medical cannabis dispensary licensure legacy.

THE STAGE IS SET, RAISE THE CURTAIN

Between 2017 and 2021, Vermont has seen monumental shifts in the regulation of THC cannabis beyond the expansion of the medical program: both passage and veto of legalization, successful passage of legalization, and successful passage of tax-and-regulate; if things go according to plan, Vermont’s medical cannabis dispensary operators will be selling cannabis to anyone 21+ as early as May 2022.

That’s good news for the three license-holders who operate the five medical cannabis dispensaries and all the affiliated businesses and share-holders. Not just for future profits, but because it turned out that the more that people were able to grow their own cannabis, the less that they wanted to register as medical patients or to shop at the licensed dispensaries, which saw their enrollments plummet following legalization of homegrow.

By Spring 2019, the medical dispensaries had formed a trade association and were collectively spending five figure sums on lobbying efforts in the Vermont Legislature. Those efforts paid off as the medical dispensaries successfully secured both an ongoing exclusive management of the medical program, as well as early access to the adult-use market through an exclusive ‘integrated license’ that would allow those dispensaries to continue to supply, manufacture, and sell their own products in the adult use market as vertically-integrated operators.

Speaking on behalf of Grassroots Vermont, a medical dispensary based in Brandon (not affiliated with High Fidelity/Ceres Project Management dispensaries), Chris Walsh told the state’s largest independent weekly newspaper at the time that the medical cannabis dispensaries’ early participation in adult use sales was their reward for paying the upfront costs of medical cannabis.

“Don’t let there be adult use or full legalization without the guys that have spent all this money to be compliant not being able to play in that arena,” he said. “I mean, that’s just asinine to me.”

The testimony in the Vermont State House echoed both the entitlement and the urgency, as the medical cannabis dispensaries, all of whom, except Grassroots Vermont were now politically consolidated as the Vermont Cannabis Trades Association, who’s members include only the four non-Grassroots dispensaries and Ceres Natural Remedies.

A different dispensary founder echoed Walsh’s point and successfully pointed to the dispensaries’ experience as regulated operators to justify early entry to the adult-use market, cited a need ‘to remain viable’, AND noted their ability to immediately generate cannabis sales revenues for the state.

“S.54 creates a system of priorities for licenses and provides for priority for existing medical cannabis dispensary license applications, as we have been licensed and regulated for 6 years by the State. We have developed protocols that abide by the laws and rules of the medical program.

To remain viable, we ask you to consider awarding each medical dispensary an adult use license that they can choose to accept. H.196 provides language that has the medical dispensaries be the first to open in the adult use market.

We would support the addition of this language to S.54 and would request that this not be a temporary license status, as considerable investment would be required to develop enough product for adult use. If we are afforded this opportunity, we will start bringing revenue into the state through adult use sales early in the process, and we would be able to subsidize the medical program.”

WHAT EXPERIENCE?

However, as Vermont’s largest independent newspaper discovered and reported in 2019, any and all information about those six years of medical dispensary operations — including patient complaints, product recalls, employee complaints, or the publicly-revealed illegal mass cultivation at a northern Vermont farm — had been blocked by both statute, and the Department of Public Safety regulators, who repeatedly sided with the dispensaries in supporting the stonewalling.

“A recent Seven Days public records request for state documents about the dispensaries laid bare the process. It revealed that the medical marijuana providers have faced few consequences for misconduct and can operate in near secrecy, without any public or legislative oversight.

In one instance, the state withheld the result of an investigation at the request of a dispensary.”

SO WHO’S WEED IS IT ANYWAYS?

While the roles of attorneys and lobbyists such as Perkinson and Mickenberg as affiliated professionals have paper trails and documentation, it’s impossible to know who actually owns shares of High Fidelity, or how much of the $35 million in stated cumulative revenue since 2013 has come from the CVD and SVW medical dispensaries, or from the CBD Natural Remedies CBD operations.

Vermont Secretary of State documents only show that High Fidelity started with 10,000 shares of common stock issued, and in May 2019, split the remaining 9,293 share of common stock into 15,000,000 total shares, with the owners of each original common stock receiving 1,000 shares of the new common stock for each of their shares of original stock.

Apart from Shayne Lynn, the Burlington attorney and city councilor William Mason IV, is the only other name that appears on High Fidelity’s 2020 annual report or any of the documents available on the Vermont Secretary of State website.

BEST PRACTICES

The strict licensing restrictions of the legal cannabis industry have certainly bred concrete instances of corruption in other northeastern states, but in Vermont, there’s nothing obviously illegal about a for-profit management company operating and controlling two medical cannabis dispensaries and a CBD company.

Considering the absurdity of the Federal tax code, it’s also not necessarily unethical for a medical cannabis dispensary to pay its employees operating expenses through another legal affiliated business, or subcontract to avoid unnecessary penalties.

If anything, these elegantly-structured technical and legal distinctions are the only things that make the cannabis industry financially viable in an environment where federal and state laws make it structurally impossible to borrow money, write off business expenses, or obtain operating licenses without institutional familiarity.

In Vermont and every other state with the lucrative potential for legal sales of THC, the layering, lobbying, and lawyering are both standard operating procedure and necessity for would-be cannabis dispensary entrepreneurs.

As savvy and well-connected political players who had observed cannabis sales in other states, the founders of Ceres Project Management and High Fidelity appear to just have learned the structural frameworks better and earlier than most of their Vermont peers, then secured their exclusive advantages through lobbying.

NEW SONG, SAME AS THE OLD SONG

Whether regulators and lawmakers knew they had created an eight-figure cannabis conglomerate, the political influence of High Fidelity and its medical dispensaries is still stronger than ever in April 2021.

A new bill, S.25, is presently being discussed in Vermont to reform the not-yet-implemented Act 164 tax-and-regulate bill, which was passed last year.

Along with the stated intentions to lower licensing fees and a business enterprise fund for minority-owned cannabis businesses, the latest version of the cannabis reform bill would create a new spot on the thirteen member advisory board specifically for the Vermont Cannabis Trade Association.

As currently proposed, that would bring the advisory board composition to one member appointed by the Vermont Cannabis Trade Association, and one single member, appointed by the Speaker of the House with both “expertise in women and minority-owned business ownership”.

WHAT NOW?

It’s also impossible to know who owns how many of those 15,000,000 shares of “Vermont’s largest independent cannabis company” and if the value of those shares is based on the CBD business, the previous medical operations, or the speculative value of the dispensary operators being exclusively permitted to sell vertically-integrated cannabis to the public in May 2022.

With the timeline of legal sales in question due to delays by Governor Phil Scott and increasing pushback from new would-be cannabis entrepreneurs, it’s not a guarantee that High Fidelity remains the largest cannabis company in Vermont when competition is allowed; however, a seven year, $35 million seems like a good start.

EPILOGUE

A new report from the Pew Research Center issued in April 2021 confirms that cannabis is more popular than ever with more than 90% of Americans who now believe that cannabis prohibition should end and cannabis should be legal for either medical or adult use purposes.

Far from any hippy ideals about communitarianism, the cannabis industry business model of acquiring, controlling, and protecting a limited number of licenses is standard practice to many of the entrepreneurs, lobbyists, consultants, and investors who hope to profit from legal cannabis in the present and future.

With sixteen states — including four in 2021 alone — having approved adult use sales, creating a paper-only business that isn’t subject to legal cannabis regulations, but can still value itself based on theoretical future legal cannabis sales will only become more popular.

All you need is a license.

Copyright © 2024 Vermontijuana

Site by CannaPlanners